AI In Insurance Market Overview

The global ai in insurance market size was valued at USD 2.74 billion in 2021, and is projected to reach USD 45.74 billion by 2031, growing at a CAGR of 32.56% from 2022 to 2031. Rising investments in AI and machine learning, growing demand for personalized insurance, and increased collaborations between insurers and tech firms are contributing to the growth of the market.

Market Dynamics & Insights

- The AI in insurance industry in North America held the largest share in 2021.

- The AI in insurance industry in Japan is expected to grow significantly at a CAGR of 40.61% from 2022 to 2031.

- By enterprise size, the large enterprises segment dominated the segment in the market, accounting for the revenue share of 78% in 2021.

- By application, the fraud detection and credit analysis segment dominated the industry in 2021 and accounted for the largest revenue share of 41%.

- By technology, the machine learning segment dominated the segment in the market, accounting for the revenue share of 51% in 2021.

Market Size & Future Outlook

- 2021 Market Size: USD 2.74 Billion

- 2031 Projected Market Size: USD 45.74 Billion

- CAGR (2022-2031): 32.56%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

What is Meant by AI in Insurance

AI (Artificial Intelligence) helps insurance companies by reducing repeatable tasks from operational teams and in performing more complex actions. Furthermore, it helps in optimizing the services that insurers provide to customers, brokers, and other external third parties, on the basis of their relationships, preferences, and past interactions.

Increase in investment by insurance companies in AI & machine learning and rise in preference for personalized insurance services boost the growth of the global AI in insurance market. In addition, increase in collaboration between insurance companies and AI & machine learning solution company positively impact growth of the AI in insurance market.

However, the high deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the AI in insurance market growth.

On the contrary, the AI in insurance market is expected to offer several opportunities for new players in the market. AI can process vast amounts of customer data, including past claims, demographics, and behaviors, to develop more accurate risk profiles. This enables the creation of personalized insurance products tailored to individual needs, more precise pricing models that adjust to specific customer risks, and dynamic underwriting processes where AI assesses risk faster and more accurately, reducing reliance on human intervention. In addition, rise in the use of AI-powered chatbots and virtual assistants enhances customer service experiences by offering 24/7 support for common queries and concerns, assisting with claim filing and updates through voice or text-based systems, delivering personalized interactions based on customer history and preferences.

Furthermore, the increase in the adoption of AI streamlines the time-consuming paperwork in insurance companies by automating the extraction of important information from documents like claims forms, policies, and contracts. In addition, the surge in the use of natural language processing (NLP) is further enhancing AI’s impact in the insurance market. NLP, a branch of AI focused on the interaction between computers and human language, is being utilized in a variety of ways to improve the efficiency and effectiveness of insurance operations. These factors are expected to offer remunerative opportunities for the growth of AI in insurance market during the forecast period.

For instance, on March 18, 2025, Accenture has recently expanded its AI Refinery platform and launched new industry agent solutions to accelerate the adoption of agentic AI. This includes an AI agent builder that allows business users to quickly create and customize advanced AI agents without coding. These solutions aim to enhance efficiency and streamline processes across various industries, including telecommunications, financial services, and insurance

Moreover, the integration of AI in the auto insurance helps to analyze telematics data from connected vehicle devices to monitor driving behavior and adjust premiums based on safe driving habits, such as pay-per-mile or pay-as-you-drive models. In addition, it can provide real-time feedback to drivers, helping them improve safety and reduce premiums. Furthermore, AI can streamline internal operations and drive down costs by automating routine administrative tasks, such as data entry and policy renewal processing. Moreover, AI helps insurance companies ensure regulatory compliance by continuously monitoring and analyzing regulatory changes, and automating compliance processes and auditing, thereby reducing the likelihood of human error. These factors are expected to offer lucrative opportunities for the growth of the AI in insurance market during the forecast period.

For instance, on Mar 10, 2025 , Ant Insurance utilized AI to help partner insurers process 7.25 million health claims in 2024, marking a 55% year-over-year increase. The AI-powered EasyClaims solution supported 85 health insurance products from 11 partner insurers, handling 96% of the 1.62 million claims analysis requests from policyholders.

AI in Insurance Market Segment Review

The ai in insurance market is segmented into Offering, Deployment Model, Technology, Enterprise Size, End-user and Application.

The AI in insurance market is segmented on the basis of offering, deployment model, technology, enterprise size, end users, application, and region. On the basis of offering, the market is categorized into hardware, software, and service. On the basis of deployment model, the AI in insurance market is bifurcated into on-premise and cloud. By technology, it is classified into machine learning, natural language processing, computer vision, and others. On the basis of enterprise size, the market is classified into large enterprise and SMEs. On the basis of end user, it is classified into life & health Insurance and property & casualty insurance. On the basis of application, the AI in insurance market is classified into fraud detection & credit analysis, customer profiling & segmentation, product & policy design, and underwriting & ai in insurance claims assessment. By region, the AI in insurance market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

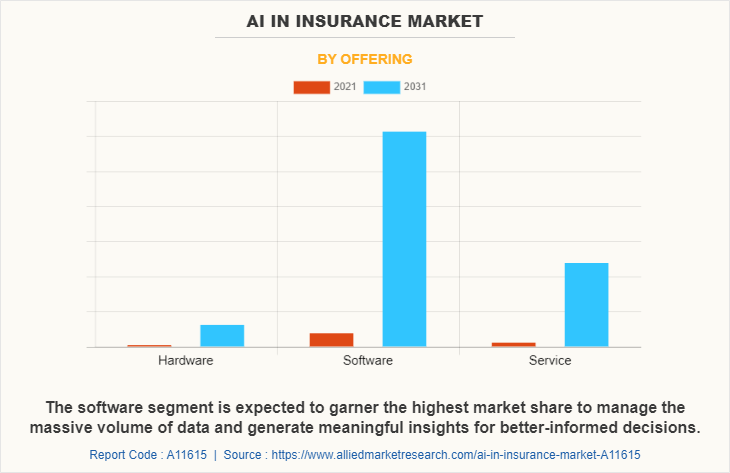

In terms of offering, the software segment holds the largest AI in insurance market share owing to, surge in demand for personalized services by the end users during the lockdown. However, the service segment is expected to grow at the highest rate during the forecast period owing to, high level of cost savings on the total cost of ownership, increased delivery speed, and quality.

Region wise, the AI in insurance market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the presence of major players that offer advanced solutions and invest heavily in solutions such as 5G and IoT technologies, which offer lucrative opportunities for the market. However, Asia-Pacific is expected to witness significant growth during the forecast period owing to rise in awareness regarding importance of strengthening the overall 5G, IoT technologies, and other technology services to ensure low-cost networking, servers, storage solution, and communications service providers (CSPs).

COVID-19 Impact Analysis

The AI in insurance market is projected to prosper in the COVID-19 situation owing to various government, public, and other ai insurance organization adopting work from home culture for their employees. In addition, various industries are adopting to promote the growth of the AI in insurance market in next-generation tech areas such as artificial intelligence for improving the loss suffered owing to the pandemic situation and to improve their market share. Furthermore, with rapid digital transformation, various governments have introduced stringent regulations to protect end users data such as General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Thus, governments in various countries have taken strict actions toward the policy limit, personal information of policy holder and coverage damages of COVID-19 regulations, and natural language processing technology is helping insurance companies to scan their internal policies as well as claims documents to check their compliance with different regulatory policies.

Moreover, insurance companies are expanding product offerings and services to make them more widely available throughout the world. As a result, there is a rise in number of Software as a Service (SaaS), cloud-based client interaction, remote connection, and fraud detection solutions during the COVID-19 pandemic. However, COVID-19 pandemic is making it even harder for larger insurers to keep pace, and even more difficult for midsize and smaller insurers to adopt AI/ML technologies, owing to long development timelines and high investment requirements.

Technology Insights

The integration of insurtech (insurance technology) and artificial intelligence (AI) is revolutionizing the insurance industry. Traditional insurance practices are increasingly being enhanced by AI, offering significant improvements in operational efficiency, customer experience, and risk management. AI-powered technologies are reshaping every aspect of insurance, from underwriting to claims processing, providing both insurers and customers with innovative solutions, driving the growth of the AI in insurance market

One of the most significant applications of AI in insurance is AI-powered underwriting. Traditionally, underwriting required manual assessment of vast amounts of data to evaluate the risks associated with a policyholder. AI streamlines this process by analyzing large datasets quickly and accurately, incorporating not only historical claims data but also emerging trends and unstructured data sources like social media. This allows insurers to make better-informed decisions, pricing policies more accurately and reducing human error. AI-driven underwriting can also improve speed, offering quicker policy approvals and helping insurers stay competitive in an increasingly fast-paced market, which in turn augments the AI in insurance market growth.

Another application of AI in the insurance sector is the use of machine learning in insurance to refine risk assessment and fraud detection. Machine learning algorithms learn from past data to predict future trends, helping insurers better assess risks associated with various policyholders. ML can also detect anomalies that could indicate fraudulent activity, which is particularly valuable in an industry that faces significant levels of fraud. These technologies continuously evolve, enhancing their accuracy and allowing insurers to respond to emerging risks in real-time. By leveraging these technologies, insurers can provide more personalized services, optimize operational costs, and enhance their ability to predict and mitigate risks, ultimately benefiting both businesses and their customers, fueling the growth of AI in insurance market

Competitive Analysis

The key players that operate in the AI in insurance market are Applied Systems, Cape Analytics, IBM Corporation, Microsoft Corporation, OpenText Corporation, Oracle Corporation, Pegasystems Inc, Quantemplate, Salesforce, Inc, SAP SE, SAS Institute Inc, Shift Technology, SimpleFinance, Slice Insurance Technologies, Vertafore, Inc, Zego, and Zurich Insurance Group Ltd. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the AI in insurance market.

Which New Products have Been Launched in the AI in Insurance Market

- In March 18, 2025, Helport AI launched its enhanced Insurance Edition, an AI-powered solution designed specifically for the insurance sector. This upgraded version aims to optimize customer interactions, streamline claims processes, and enhance policy management. The company has partnered with five independently owned U.S. insurance agencies to pilot the solution, which includes capabilities such as AI-driven expertise, smart marketing, personalized recommendations, real-time compliance, and risk management.

- In July 4, 2024, ICICI Lombard's new AI-powered health insurance plan, Elevate, offering personalized coverage with flexible options, value-added services like reward points for healthy habits, comprehensive coverage including AYUSH and modern treatments, and unlimited doctor teleconsultations. This plan aims to make health insurance more accessible and tailored to individual needs.

- In February 12, 2024, Vouch launched a novel insurance product called AI Insurance, designed to help AI startups survive lawsuits and innovate faster. This product covers critical AI risks, including errors, discrimination, regulatory mistakes, and intellectual property disputes. This development is indeed related to the AI in the insurance market, as it provides specialized coverage tailored to the unique risks faced by AI startups.

- In December 11, 2024, Patra launched its AI-powered services designed to automate the insurance industry. These services aim to improve profitability, scalability, and customer satisfaction for agents, brokers, wholesalers, and MGAs. Key features include automating workflows like data extraction, policy checking, and quote comparisons, which can enhance operational efficiencies by up to 300%.

Recent Partnerships in the Market

- In February 25, 2025, Finders partnered with Dnotitia to apply AI in insurance data analysis. This collaboration aims to refine risk evaluation and underwriting processes by utilizing AI-optimized models and leveraging insurance distribution and sales data12. The partnership will enhance the accuracy of insurance data analysis, improve agent-client matching, and simplify the insurance purchasing process. This development is indeed related to the AI in the insurance market, as it demonstrates how AI can be used to improve operational efficiency and provide more personalized insurance solutions.

- In January 16, 2025, Meiji Yasuda Life Insurance partnered with Accenture to drive an AI-led business reinvention. This collaboration aims to enhance workforce productivity and innovation by integrating AI technologies, such as AI-enabled digital assistants, into Meiji Yasuda's operations. The initiative focused on product development and talent cultivation, supporting the company's vision of becoming an industry-leading life insurer.

- In December 11, 2024, Suncorp partnered with Microsoft to accelerate the use of AI and cloud technology to transform the insurance industry. This collaboration aims to integrate AI at scale across Suncorp's operations, enhancing customer interactions and streamlining internal processes. They plan to implement 20 new AI applications within the current financial year, supported by an AI Steering Committee to ensure responsible use.

What are the Top Impacting Factors in AI in Insurance Market

Increase in investment by insurance companies in AI and machine learning

Insurance companies are increasing investment in machine learning and AI solutions to transform the management process of insurtech and to provide better services to end users in AI in insurance market. In addition, with incase in complexity and competition in the insurance sector, the demand for industry-specific solutions increased to meet its goals. Thus, to meet the requirement of customers, various insurance companies and insurtech are investing in AI solution, which, in turn, drives the growth of the AI in insurance industry. Furthermore, AI and machine learning can assist insurance companies at various stages of risk management process ranging from identifying risk exposure, measuring, estimating, and assessing its effects.

In addition, insurance companies are adopting and developing machine learning techniques to analyze large volume of data and to deliver valuable insights to customers. Moreover, increase in investments in AI and advanced machine learning by insurtech to enhance the automation process and to offer more streamlined and personalized customer experience propels the growth of the AI in insurance market. For instance, on June 2022 MS&AD Indian based company partnered with Akur8 is revolutionizing insurance pricing with transparent AI this partnership helps to foster further innovation development processes by automating risk modeling, using transparent artificial intelligence proprietary technology it benefits for insurers to increase predictive performance and speed-to-accuracy for higher market reactivity and immediate business impact, while maintaining full transparency and control on the models created, thus augmenting the growth of the AI in insurance market.

Rise in preference for personalized insurance services

End users are increasingly preferring personalized insurance services, owing to surge in adoption of chatbots among personalize insurance services and increase in competition among the insurance companies for garnering maximum market share. Various insurance companies are providing budget management apps powered by machine learning, which help customers to achieve their financial targets and improve their money management process, thus driving the growth of the market.

Furthermore, robo-advisors are one of the other rapidly emerging trends in personalized insurance services, as they specifically target investors with limited resources such as individuals and small- to medium-sized businesses for managing their funds. In addition, machine learning-based robo-advisors can apply traditional data processing techniques with algorithms to create client portfolios and solutions such as trading, investments, and retirement plans for their users. For instance, on April 2022 CLARA Analytics has released CLARA Optics, a software product that uses AI and machine learning to scan, sort and analyze bills and medical documents to create a claim-based medical record and helps to provides artificial intelligence technology for the commercial insurance industry.

Moreover, with rise of usage-based insurance machine learning and AI technologies are helping to calculate the premium suitable for each individual, which, in turn, propels the growth of the market.

Opportunity

Government initiatives and rise in investments to leverage the AI technology

The AI in insurance market is expected to witness notable growth during the forecast period. The integration of AI technology into the insurance industry has been significantly fueled by government initiatives and a rise in investments aimed at leveraging its transformative potential. Governments across the globe are recognizing the value of AI in driving efficiency, enhancing customer experiences, and improving risk management in the insurance sector. These initiatives often come in the form of policy frameworks, financial incentives, and research funding aimed at encouraging innovation and adoption of AI tools within the industry.

For instance, many governments are investing in AI research and development, offering grants, tax breaks, and subsidies to companies that develop AI-driven solutions for insurance. This is particularly true in regions like North America, Europe, and Asia, where AI adoption in insurance is growing rapidly. These efforts are often accompanied by regulatory adjustments that create a favorable environment for AI technology, ensuring that ethical considerations, data privacy, and fairness are prioritized while still allowing for innovation.

The rise in investments from both public and private sectors further accelerates the adoption of AI in insurance in AI in insurance market. Investors are eager to finance AI startups and established businesses that are delving into innovative uses, including predictive analytics for underwriting, claims automation, fraud detection, and customized customer experiences. These developments are anticipated to reduce operational expenses, improve decision-making processes, and create novel products designed for customer preferences, all of which foster a more competitive insurance landscape.

Moreover, the integration of AI significantly enhances risk assessment and management, enabling insurance providers to gain insights into customer behaviors, forecast trends, and reduce potential risks in AI in insurance market. In addition, the government's support and funding for AI technology presents possibilities for insurance firms to innovate has led to the development of a more sophisticated, data-centric insurance environment.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the AI in insurance market segments, current trends, estimations, and dynamics of the ai in insurance market analysis from 2021 to 2031 to identify the prevailing ai in insurance market opportunities.

- The AI in insurance market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ai in insurance market outlook segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global ai in insurance market opportunity.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the AI in insurance market players.

- The report includes the analysis of the regional as well as global ai in insurance market trends, key players, market segments, application areas, and ai in insurance market forecast strategies.

AI in Insurance Market Report Highlights

| Aspects | Details |

| By Offering |

|

| By Deployment Model |

|

| By Technology |

|

| By Enterprise Size |

|

| By End-user |

|

| By Application |

|

| By Region |

|

| Key Market Players | SAP SE, Zego, Pegasystems Inc., Vertafore, Inc., Oracle Corporation, SimpleFinance, Shift Technology, IBM Corporation, SAS Institute Inc., Applied Systems, Microsoft Corporation, Slice Insurance Technologies, OpenText Corporation, Quantemplate, Salesforce, Inc. |

Analyst Review

According to insights of the market growth of leading companies, cloud-based AI insurance solutions is expected to dominate the market share for effective digitization of business processes with the security of private cloud and offers greater control, reduced risk, cost efficiency, and better performance. In addition, Asia-Pacific exhibits high growth potential owing to change in landscape in telecom sector with changes in customer demand and growth in digitization across the Asia-Pacific countries. Furthermore, increased cloud enabled activities and growth in cloud marketplace trends in Asia-Pacific are expected to drive the growth of the market.

Key providers of the AI in insurance market such as IBM Corporation, Microsoft Corporation, and SAP SE account for a significant share in the market. With growth in requirement for AI in insurance, various companies have established alliance to increase their capabilities. For instance, in January 2022, Root Insurance US Insurtech Company partnered with artificial based company Tractable. This partnership is anticipated to therefore see Root integrate Tractable’s AI solutions with its material damage claims processes, starting with newly launched AI subro product by Tractable which is anticipated to aid in reviewing damage photos in inbound subrogation demands.

In addition, with further growth in investment across the world, the rise in demand for artificial intelligence in insurance, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in February 2022, Edelweiss General Insurance an Indian based company, launched an AI voice bot to expedite registration of motor claims. In addition, the AI Voice Bot is the first in general insurance industry in India, and is powered by Yellow.ai, the world’s leading next-gen Total Experience (TX) Automation Platform. Moreover, this voice bot is anticipated to assist EGI’s garage representatives in easier, faster, and hassle-free registration of claims. For instance, on March 2022 Intellimation.ai Natural Language Processing (NLP) and Machine Learning (ML) based cognitive fintech company launched product ADEPT for the insurance and insurance brokerage industry. In addition, with this product insurance brokers can embed and operationalize AI through an automated assembly line to ingest and interpret all types of structured and unstructured data, across a range of products related workflows

Moreover, with increase in competition, major market players have started acquiring companies to expand their market penetration and reach. For instance, December 2021, Zurich Insurance Group acquired AlphaChat, communications service providers all around world with AI and machine learning specialists’ service assurance solutions across globe. The acquisition of AlphaChat marks an important moment for Zurich. The integration of its multi-disciplinary highly skilled team and expanded best in class contract are projected reinforce the ability to deliver on transformative digital initiatives for their customers.

Increase in investment by insurance companies in AI & machine learning and rise in preference for personalized insurance services boost the growth of the global AI in insurance market.

Region wise, the AI in insurance market size was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the presence of major players that offer advanced solutions and invest heavily in solutions such as 5G and IoT technologies, which offer lucrative opportunities for the market.

The global AI in insurance market was valued at $2.74 billion in 2021, and is projected to reach $45.74 billion by 2031, registering a CAGR of 32.6% from 2022 to 2031

The key players that operate in the AI in insurance market are Applied Systems, Cape Analytics, IBM Corporation, Microsoft Corporation, OpenText Corporation, Oracle Corporation, Pegasystems Inc, Quantemplate, Salesforce, Inc, SAP SE, SAS Institute Inc, Shift Technology, SimpleFinance, Slice Insurance Technologies, Vertafore, Inc, Zego, and Zurich Insurance Group Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...